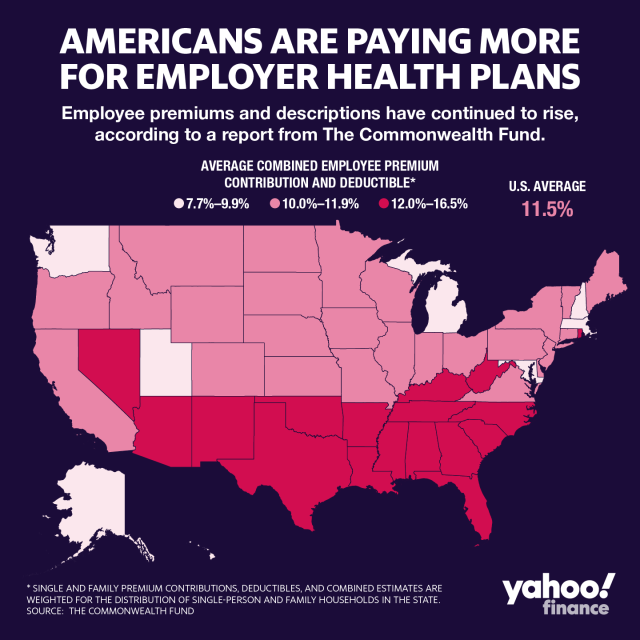

In Mississippi, for example, people could spend more than 16% of their incomes on premiums and meeting deductibles, compared to an average cost burden of 8.4% in Massachusetts,” the report stated. “In Mississippi, combined premiums and deductibles are higher than those in Massachusetts, and Mississippi has the second-lowest median income in the country ($47,800). In contrast, median income in Massachusetts is among the nation’s highest ($81,913).”

Over the last decade, U.S. median income has not kept pace of families’ premium costs in employer health plans,” Sara Collins, president at the Commonwealth Fund, told Yahoo Finance. “At the same time, deductibles in these plans have also grown faster than income, leaving many families underinsured. People across the country are not experiencing employer health insurance costs equally. The most cost-burdened families are in the South aka Trump Country.

The rising cost issue is due to the repeal of the individual mandate penalty by the Trump administration in 2017. At the time this occurred, the Congressional Budget Office (CBO) estimated that “average premiums in the nongroup market would increase by about 10% in most years of the decade (with no changes in the ages of people purchasing insurance accounted for) relative to CBO’s baseline projections.” According to CBO, this is because “healthier people would be less likely to obtain insurance” and because the premium increase would dissuade others from buying insurance.

No comments:

Post a Comment